does texas have a death tax

Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Texas has no income tax and it doesnt tax estates either.

Your Holy Name Can Save Us So Let Your Glory Fall

The top estate tax rate is 20 percent exemption threshold.

. Texas does not have an estate tax either. Higher rates are found in locations that lack a property tax. 19 went into effect resurrecting a death tax on property that voters had eliminated back in 1986.

Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property. There is a 40 percent federal. No estate tax or inheritance tax.

For amounts over 1 million those funds will be taxed at a rate of 40. Call or Text 817 841-9906. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

If you have an estate that is big enough. Tax is tied to federal state death tax credit. TRS may be notified by calling toll-free at 1-800-223-8778.

Here is how the death tax works. Taxes imposed by the federal andor state government on someones estate upon their death. TRS will require the name address and telephone number of a family member friend or other person who can act as a contact for TRS as well as the TRS participants date of death.

No there is currently also no inheritance tax in Texas for. Texas also imposes a cigarette tax a gas tax and a hotel tax. At that time TRS will request that a copy of the death certificate be provided when it becomes.

At the Federal level the tax rates exist on a sliding scale similar to income tax rates. Understanding how Texas estate tax laws apply to your particular situation is critical. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirsit only applies to estates that reach a certain threshold.

A transfer on death deed has no legal effect during the owners life so state ad valorem property tax exemptions are not affected. No estate tax or inheritance tax. One of the big question marks though is what.

What are the state and federal tax consequences of a Texas TODD. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. If your gross estate is over 114 million you pay a tax on the overage.

If that was the case then giving the assets to her spouse would have been the only way to prevent estate taxes until after his death she explains. Prior to September 15 2015 the tax was tied to the federal state death tax credit. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

On the low end of the scale the rates are 18 for taxable amounts less than 10000. No estate tax or inheritance tax. There is a 40 percent federal tax however on estates over 534.

Alaska is one of five states with no state sales tax. The federal estate tax disappears in 2010. Federal estate taxes do not apply to most people.

The higher the value of the estate the higher the tax rate you will pay. Today one year later thousands of families have personally encountered the unwelcome and cruel return of the death tax. However localities can levy sales taxes which can reach 75.

UT ST 59-11-102. Texas does not have an estate tax either. Specifically on February 16 2021 Prop.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. The top estate tax rate is 16 percent exemption threshold. The difference between the inheritance and estate taxes is the fact that the latter applies to the estate of the recently deceased before the assets are transferred to the heir.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after January 1 2022. No estate tax or inheritance tax.

Property conveyed by a Texas TODD is treated the same as probate property so beneficiaries receive a stepped up federal basis. These taxes are levied on the beneficiary that receives the property in the deceaseds will. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

What Is The Probate Process In Texas A Step By Step Guide

Domestic Tax Director Texas At Taxjobz Com

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

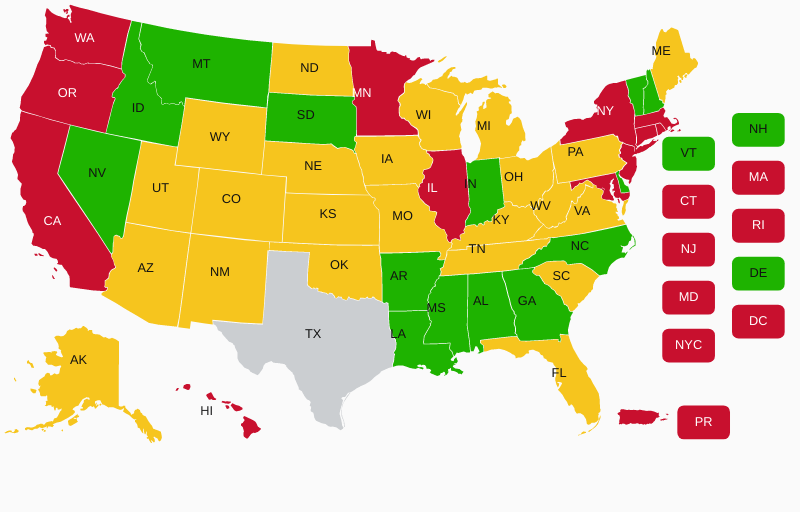

Texas Gun Laws Ltc Uscca Ccw Reciprocity Map Last Updated 09 01 2021

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

Pin On Bonnie And Clyde This Shit

Foreigners Bought 18 7 Billion Worth Of Houses In Texas In 12 Months First Time Home Buyers Home Buying Best Places To Live

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Estate Tax Everything You Need To Know Smartasset